Inflation in 1986 and its effect on dollar value

$1 in 1985 is equivalent in purchasing power to about $1.02 in 1986. The dollar had an average inflation rate of 1.86% per year between 1985 and 1986, producing a cumulative price increase of 1.86%. Purchasing power decreased by 1.86% in 1986 compared to 1985. On average, you would have to spend 1.86% more money in 1986 than in 1985 for the same item.

This means that prices in 1986 are 1.02 times as high as average prices since 1985, according to the Bureau of Labor Statistics consumer price index.

The inflation rate in 1985 was 3.56%. The inflation rate in 1986 was 1.86%. The 1986 inflation rate is lower compared to the average inflation rate of 2.78% per year between 1986 and 2025.

Inflation rate is calculated by change in the consumer price index (CPI). The CPI in 1986 was 109.60. It was 107.60 in the previous year, 1985. The difference in CPI between the years is used by the Bureau of Labor Statistics to officially determine inflation.

| Average inflation rate | 1.86% |

| Converted amount $1 base | $1.02 |

| Price difference $1 base | $0.02 |

| CPI in 1985 | 107.600 |

| CPI in 1986 | 109.600 |

| Inflation in 1985 | 3.56% |

| Inflation in 1986 | 1.86% |

| $1 in 1985 | $1.02 in 1986 |

Inflation by City

Inflation can vary widely by city, even within the United States. Here's how some cities fared in 1985 to 1986 (figures shown are purchasing power equivalents of $1):

- San Diego, California: 7.62% average rate, $1 → $1.08, cumulative change of 7.62%

- New York: 3.28% average rate, $1 → $1.03, cumulative change of 3.28%

- Atlanta, Georgia: 3.13% average rate, $1 → $1.03, cumulative change of 3.13%

- San Francisco, California: 3.11% average rate, $1 → $1.03, cumulative change of 3.11%

- Boston, Massachusetts: 2.73% average rate, $1 → $1.03, cumulative change of 2.73%

- Philadelphia, Pennsylvania: 2.48% average rate, $1 → $1.02, cumulative change of 2.48%

- Chicago, Illinois: 2.09% average rate, $1 → $1.02, cumulative change of 2.09%

- Dallas-Fort Worth, Texas: 1.75% average rate, $1 → $1.02, cumulative change of 1.75%

- Miami-Fort Lauderdale, Florida: 1.46% average rate, $1 → $1.01, cumulative change of 1.46%

- St Louis, Missouri: 1.45% average rate, $1 → $1.01, cumulative change of 1.45%

- Detroit, Michigan: 1.40% average rate, $1 → $1.01, cumulative change of 1.40%

- Minneapolis-St Paul, Minnesota: 1.31% average rate, $1 → $1.01, cumulative change of 1.31%

- Seattle, Washington: 1.11% average rate, $1 → $1.01, cumulative change of 1.11%

- Denver, Colorado: 0.75% average rate, $1 → $1.01, cumulative change of 0.75%

- Houston, Texas: -0.80% average rate, $1 → $0.99, cumulative change of -0.80%

San Diego, California experienced the highest rate of inflation during the 1 years between 1985 and 1986 (7.62%).

Houston, Texas experienced the lowest rate of inflation during the 1 years between 1985 and 1986 (-0.80%).

Note that some locations showing 0% inflation may have not yet reported latest data.

Inflation by Country

Inflation can also vary widely by country. For comparison, in the UK £1.00 in 1985 would be equivalent to £1.03 in 1986, an absolute change of £0.03 and a cumulative change of 3.40%.

In Canada, CA$1.00 in 1985 would be equivalent to CA$1.04 in 1986, an absolute change of CA$0.04 and a cumulative change of 4.19%.

Compare these numbers to the US's overall absolute change of $0.02 and total percent change of 1.86%.

Inflation by Spending Category

CPI is the weighted combination of many categories of spending that are tracked by the government. Breaking down these categories helps explain the main drivers behind price changes.

Between 1985 and 1986:

- Gas prices increased from $1.15 per gallon to $1.19

- Bread prices increased from $0.55 per loaf to $0.57

- Egg prices increased from $0.75 per carton to $0.90

- Chicken prices increased from $0.77 per per 1 lb of whole chicken to $0.77

- Electricity prices increased from $0.08 per KwH to $0.08

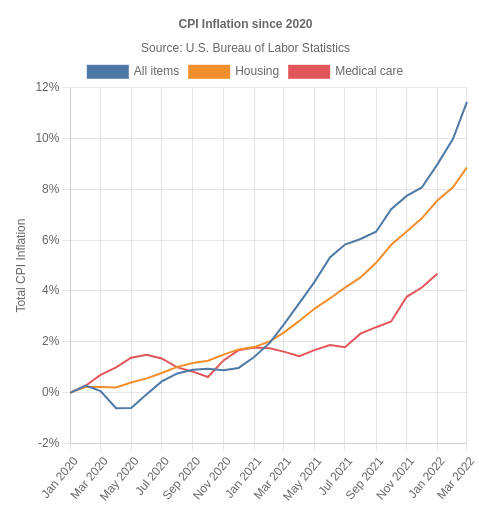

This chart shows the average rate of inflation for select CPI categories between 1985 and 1986.

Compare these values to the overall average of 1.86% per year:

| Category | Avg Inflation (%) | Total Inflation (%) | $1 in 1985 → 1986 |

|---|---|---|---|

| Food and beverages | 3.26 | 3.26 | 1.03 |

| Housing | 2.96 | 2.96 | 1.03 |

| Apparel | 0.85 | 0.85 | 1.01 |

| Transportation | -3.89 | -3.89 | 0.96 |

| Medical care | 7.51 | 7.51 | 1.08 |

| Recreation | 0.00 | 0.00 | 1.00 |

| Education and communication | 0.00 | 0.00 | 1.00 |

| Other goods and services | 6.05 | 6.05 | 1.06 |

For all these visualizations, it's important to note that not all categories may have been tracked since 1985. This table and charts use the earliest available data for each category.

How to calculate inflation rate for $1, 1985 to 1986

Our calculations use the following inflation rate formula to calculate the change in value between 1985 and 1986:

Then plug in historical CPI values. The U.S. CPI was 107.6 in the year 1985 and 109.6 in 1986:

$1 in 1985 has the same "purchasing power" or "buying power" as $1.02 in 1986.

To get the total inflation rate for the 1 years between 1985 and 1986, we use the following formula:

Plugging in the values to this equation, we get:

Alternate Measurements of Inflation

There are multiple ways to measure inflation. Published rates of inflation will vary depending on methodology. The Consumer Price Index, used above, is the most common standard used globally.

Alternative measurements are sometimes used based on context and economic/political circumstances. Below are a few examples of alternative measurements.

Personal Consumption Expenditures (PCE) Inflation

The PCE Price Index is the U.S. Federal Reserve's preferred measure of inflation, compiled by the Bureau of Economic Analysis. It measures the change in prices of goods and services purchased by consumers.

The PCE Price Index changed by 2.18% per year on average between 1985 and 1986. The total PCE inflation between these dates was 2.18%. In 1985, PCE inflation was 3.49%.

This means that the PCE Index equates $1 in 1985 with $1.02 in 1986, a difference of $0.02. Compare this to the standard CPI measurement, which equates $1 with $1.02. The PCE measured 0.32% inflation compared to standard CPI.

For more information on the difference between PCE and CPI, see this analysis provided by the Bureau of Labor Statistics.

Core Inflation

Also of note is the Core CPI, which uses the standard CPI but omits the more volatile categories of food and energy.

Core inflation averaged 4.04% per year between 1985 and 1986 (vs all-CPI inflation of 1.86%), for an inflation total of 4.04%. In 1985, core inflation was 4.37%.

When using the core inflation measurement, $1 in 1985 is equivalent in buying power to $1.04 in 1986, a difference of $0.04. Recall that the converted amount is $1.02 when all items including food and energy are measured.

Comparison to S&P 500 Index

To help put this inflation into perspective, if we had invested $1 in the S&P 500 index in 1985, our investment would be nominally worth approximately $1.66 in 1986. This is a return on investment of 66.07%, with an absolute return of $0.66 on top of the original $1.

These numbers are not inflation adjusted, so they are considered nominal. In order to evaluate the real return on our investment, we must calculate the return with inflation taken into account.

The compounding effect of inflation would account for 1.82% of returns ($0.03) during this period. This means the inflation-adjusted real return of our $1 investment is $0.63. You may also want to account for capital gains tax, which would take your real return down to around $1 for most people.

| Original Amount | Final Amount | Change | |

|---|---|---|---|

| Nominal | $1 | $1.66 | 66.07% |

| Real Inflation Adjusted | $1 | $1.63 | 63.04% |

Information displayed above may differ slightly from other S&P 500 calculators. Minor discrepancies can occur because we use the latest CPI data for inflation, annualized inflation numbers for previous years, and we compute S&P price and dividends from January of 1985 to latest available data for 1986 using average monthly close price.

For more details on the S&P 500 between 1985 and 1986, see the stock market returns calculator.

Data source & citation

Raw data for these calculations comes from the Bureau of Labor Statistics' Consumer Price Index (CPI), established in 1913. Price index data from 1774 to 1912 is sourced from a historical study conducted by political science professor Robert Sahr at Oregon State University and from the American Antiquarian Society. Price index data from 1634 to 1773 is from the American Antiquarian Society, using British pound equivalents.

You may use the following MLA citation for this page: “Inflation Rate in 1986 | Inflation Calculator.” Official Inflation Data, Alioth Finance, 9 May. 2025, https://www.officialdata.org/inflation-rate-in-1986.

Special thanks to QuickChart for their chart image API, which is used for chart downloads.

in2013dollars.com is a reference website maintained by the Official Data Foundation.

| Average inflation rate | 1.86% |

| Converted amount $1 base | $1.02 |

| Price difference $1 base | $0.02 |

| CPI in 1985 | 107.600 |

| CPI in 1986 | 109.600 |

| Inflation in 1985 | 3.56% |

| Inflation in 1986 | 1.86% |

| $1 in 1985 | $1.02 in 1986 |